HTML tags:

Bonnie and Clyde, Ma Barker, Baby Face Nelson, and Willie Sutton are famous for robbing banks. When asked why he did it, Sutton famously replied “because that’s where the money is.” If banks’ $3.1 trillion in cash and invested assets draws criminals to steal from banks, the insurance industry’s $10 trillion in assets arguably tempts fraudsters even more. And it does. Whereas banks’ annual losses from fraud are on the order of $2.7 billion, insurance fraud measures a staggering $308.6 billion annually.

The FBI, which prosecutes significant insurance fraud cases, affirms the insurance industry’s massive size “contributes significantly to the cost of insurance fraud by providing more opportunities and bigger incentives for committing illegal activities.” And from the fraudster’s point of view, insurance fraud is a crime not requiring a gun, a mask, or a getaway car.

In an era of congressional hearings on how to reduce the cost of insurance for consumers, one solution is to attack insurance fraud. Insurers’ fraud-related losses are passed onto all policyholders. If insurance fraud were wiped out, premiums would be 10 percent lower. Insurance fraud is the second-largest category of white-collar crime, following tax evasion.

Insurers’ massive hemorrhaging from fraud makes theft in other industries pale by comparison. Retailer shrink (theft) rate is 1.6 percent. Wholesaler/inventory shrink rate is estimated at 4 percent. Insurance fraudsters may justify cheating an insurance company because it is thought to be a victimless crime.

In a recent survey of attitudes surrounding insurance fraud, almost 9 percent of respondents justified insurance fraud as not being wrong or criminal based on their belief that “insurance companies rip people off, so it’s fair” and “I pay them enough, it’s my money I’m getting back.” The survey revealed a high percentage of respondents (28.6% percent) finding insurance fraud “not a real crime” (8.5 percent) or constituted a “business practice with no real victim” (20.1 percent).

Insurance fraud comes in many forms and sizes. It ranges from registering automobiles in a state other than the state of one’s residence because fees and insurance there can “save” hundreds of dollars, to a recently uncovered scheme which scammed Medicare $2 billion.

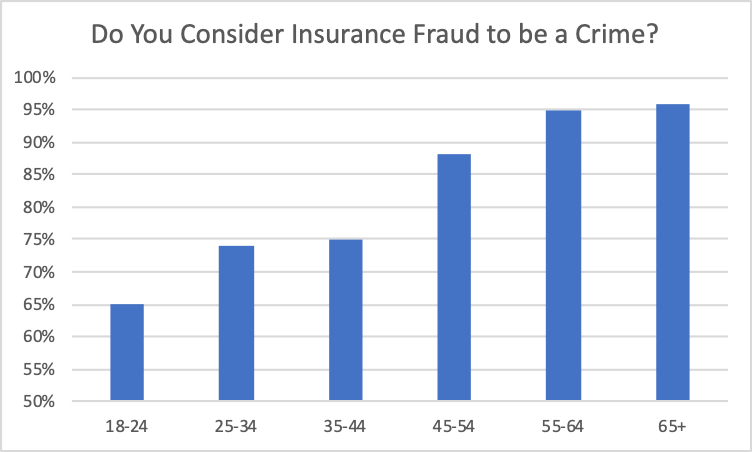

Whether someone considers insurance fraud a crime or not depends to some degree on their age. In the report presenting findings of the “Who Me?” study, respondents 45 and older were much more prone to consider insurance fraud a crime. For the youngest respondents, aged 18 to 24, just under 65 percent did, whereas 96 percent of respondents 65 and older did.

Some of the most chilling examples of insurance fraud are grisly affairs revealing the darkest of humanity’s dark side. John Gilbert Graham placed a time-release bomb on a plane in which his mother was traveling, for the life insurance payment. The bomb exploded. In addition to Graham’s mother, all 43 other passengers and crew perished.

There are multiple organizations combatting insurance fraud. In 42 states the insurance department has a fraud investigation unit. In other states, such as Colorado, insurance fraud investigations are the responsibility of the Attorney General’s office.

Improvements in predictive modeling and the introduction of artificial intelligence (AI) have strengthened insurers’ abilities to identify, and ultimately investigate, submitted claims that may be fraudulent. At the same time, however, AI is also being used as a weapon to penetrate insurers’ fraud detection systems.

Insurers need to strengthen their inoculation against the insurance fraud germ. They should educate younger generations to know that insurance fraud is indeed a crime, regardless if they think otherwise. In today’s populist political environment, big business, including insurers, is too often singled out as responsible for whatever ills there may be. Insurers should also join forces with other parties battling insurance fraud – state insurance department fraud units, local and federal law enforcement, and organizations such as the Coalition Against Insurance Fraud and the National Insurance Crime Bureau. As insurance fraudsters exploit new technologies, and as the younger generations with negative views on insurance become policyholders, the fight may get tougher, but it must be fought if combatting insurance crime can ever be a driver of lower insurance rates.